By following the step-by-step guide outlined in this article, companies can ensure accurate and timely period cost calculations, providing a solid foundation for informed business decisions. Every cost incurred by a business can be classified as either a period cost or a product cost. A product cost is incurred during the manufacture of a product, while a period cost is usually incurred over a period of time, irrespective of any manufacturing activity. A product cost is initially recorded as inventory, which is stated on the balance sheet. Once the inventory is sold or otherwise disposed of, it is charged to the cost of goods sold on the income statement.

Take a Better Approach to Managing CAC Payback Period with G-Squared Partners

- Calculating the Total Period Cost is essential for businesses and financial analysis.

- These costs are typically non-manufacturing costs, such as salaries, rent, insurance, and utilities.

- By optimizing spending, monitoring performance, and making data-driven decisions, businesses can enhance their competitiveness, maximize profitability, and achieve long-term success.

- According to generally accepted accounting principles (GAAPs), all selling and administrative costs are treated as period costs.

- By following these steps and formulas, businesses can accurately calculate their period cost, providing valuable insights into their financial performance and profitability.

- Depreciation expense is calculated using various methods such as straight-line depreciation, declining balance depreciation, and units of production depreciation.

Period cost refers to the costs incurred by a company during a specific accounting period, such as a month, quarter, or year. In this article, we’ll delve into the process of calculating period cost, highlighting the key steps and formulas involved. The tax implications of period costs are an intricate aspect of fiscal management that can influence a company’s tax liability.

What is the approximate value of your cash savings and other investments?

Managing your CAC Payback Period effectively requires strategic insight and reliable financial data. While the calculations might seem straightforward, the real challenge lies in gathering accurate data, interpreting the results, and implementing improvements that align with your business goals. By leveraging budgeting and forecasting techniques, businesses can improve financial planning, optimize resource allocation, and enhance decision-making capabilities. For information pertaining to the registration status of 11 Financial, please contact the state how to calculate period costs securities regulators for those states in which 11 Financial maintains a registration filing. Period expenses are important to know about because they can have a direct impact on both reducing costs and increasing revenue.

How much are you saving for retirement each month?

- This mixing makes it impossible for managers to know the current period expense of manufacturing the product.

- By following the step-by-step guide outlined in this article, companies can ensure accurate and timely period cost calculations, providing a solid foundation for informed business decisions.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

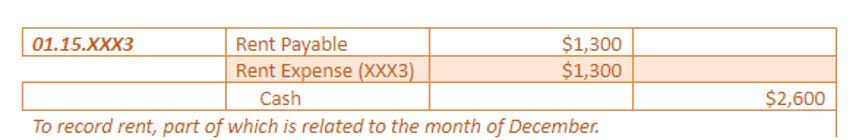

- For instance, office rent is recorded as an expense in the month it is paid, irrespective of the sales activities of that month.

- It is important to keep track of your total period cost because that information helps you determine the net income of your business for each accounting period.

There are types of period costs that may not be included in the financial statements but are still monitored by the management. The management accountant must carefully evaluate the time expenditure to see if it will be included in the income statement. While growth and revenue often steal the spotlight, understanding core financial metrics helps companies build sustainable, profitable businesses that can weather market turbulence and scale effectively.

In manufacturing companies, theses costs usually consist of direct materials, direct labor, and manufacturing overhead cost. Indirect allocation requires careful consideration of allocation bases to ensure that costs are allocated fairly and accurately. Common methods of indirect allocation include the use of predetermined overhead rates or activity-based costing (ABC) systems. Direct allocation provides a simple and transparent way to assign costs to cost objects, making it easier to trace expenses and calculate the true cost of producing goods or services.

- For instance, a spike in rental expenses due to market changes would necessitate a reevaluation of pricing to ensure that the increased costs do not erode profit margins.

- For example, John & Muller company manufactures 500 units of product X in year 2022.

- A product cost is initially recorded as inventory, which is stated on the balance sheet.

- When the product is sold, these costs are transferred from inventory account to cost of goods sold account and appear as such on the income statement of the relevant period.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- When setting prices for products or services, businesses must ensure that all costs, including period costs, are covered to maintain profitability.

- Product costs are all the costs that are related to producing a good or service.

- This is in accordance with the matching principle of accounting, which dictates that expenses should be matched with the revenues they help to generate in the same period.

- During the fourth quarter of 2016, Company XYZ expected to pay $150,000 in rent and utilities and $100,000 in insurance and property taxes.

- By implementing robust performance evaluation and monitoring processes, businesses can identify cost-saving opportunities, optimize resource utilization, and drive sustainable growth and profitability.

- So, it is only for that accounting period that period costs will reduce the net income.

Analyzing trends in Period Costs allows stakeholders to identify cost-saving opportunities, assess cost management https://www.bookstime.com/ effectiveness, and evaluate overall financial performance. Liabilities are normally things that are settled over time through the transfer of money, goods, or services. Liabilities can either be short-term obligations that are due within one year of a normal accounting period, or they can be long-term liabilities and are not due for more than one accounting period.

What could be considered a period expense?

Effective inventory management and production planning can help mitigate the impact of variable costs on profitability. The inclusion of period costs in pricing decisions also involves a strategic component. retained earnings Companies may decide to absorb certain period costs temporarily to gain market share or enter a new market, setting prices that are competitive yet may not fully cover these expenses in the short term. This approach can be particularly effective in industries where customer acquisition costs are high, but the lifetime value of a customer is significant. The pricing strategy must then be adjusted over time as the business scales and these costs become a smaller proportion of the total expenses. The immediate expensing of period costs has a direct impact on a company’s profit and loss statement.

By leveraging Period Cost data in decision-making processes, businesses can enhance operational efficiency, mitigate risks, and achieve sustainable growth and profitability in the long term. Period expenses appear on the income statement with an appropriate caption for the item, which acts as a disclosure, in the period when the cost is incurred or recognized. For example, it costs your company $1,200 to acquire a new customer who generates $200 in monthly recurring revenue. To calculate how long it takes to make that money back, we’ll put the numbers into the formula to get the CAC Payback Period. Product costs only become an expense when the products to which they are attached are sold.